Our Articles on Debt topics & related issues

Welcome to PF Fin's articles section, your go-to resource for comprehensive insights into Non-Performing Assets (NPAs), debt-related issues, loans, and various other topics pertaining to the world of finance. Navigate through our collection of articles to gain a deeper understanding of the complexities surrounding debt and its implications on individuals, businesses, and the economy.

Following are some of our artices:

Understanding Non-Performing Assets (NPA): Causes and Resolutions

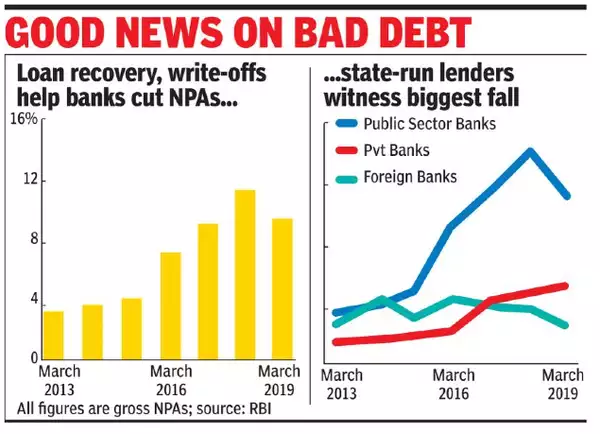

Non-Performing Assets (NPAs) are a critical concern for financial institutions and the overall health of an economy. NPAs, also known as bad loans, are loans on which the borrower has failed to make interest or principal repayments for a specific period. This phenomenon poses a threat to the stability of financial institutions and can hinder economic growth. In this article, we will delve into the causes of NPAs and explore potential resolutions to mitigate their impact.

Causes of NPAs

Delve into the fundamentals of NPAs, exploring their causes, consequences, and potential solutions. Learn how financial institutions tackle the challenges posed by non-performing loans.

Economic Downturn:

One of the primary causes of NPAs is an economic downturn. During periods of economic instability, businesses face financial challenges, leading to a decline in their ability to repay loans. This results in an increase in the number of NPAs for banks and financial institutions.

Inadequate Risk Assessment:

Financial institutions may sometimes extend credit without conducting a thorough risk assessment of the borrower. Poor credit appraisal processes can lead to the sanctioning of loans to borrowers who may struggle to repay, contributing to the creation of NPAs.

Insufficient Monitoring and Recovery Mechanisms:

Inadequate monitoring of loans and a lack of efficient recovery mechanisms can contribute to the accumulation of NPAs. Financial institutions must implement robust systems for monitoring borrower activities and initiating timely recovery measures when signs of default emerge.

External Factors:

External factors such as changes in government policies, regulatory frameworks, or global economic conditions can impact the financial health of businesses, leading to an increase in NPAs.

Corporate Governance Issues:

Weak corporate governance within borrowing entities can contribute to NPAs. Lack of transparency, accountability, and unethical practices can lead to financial distress and loan defaults.

Resolutions for NPAs

Strengthening Risk Management Practices:

Financial institutions must enhance their risk management practices, including rigorous credit appraisal procedures, regular risk assessments, and stress testing. This can help identify potential defaults and prevent the creation of NPAs.

Timely and Effective Monitoring:

Implementing robust monitoring mechanisms is crucial. Financial institutions should continuously track the financial health of borrowers and take proactive measures at the first signs of distress. Early identification can significantly reduce the impact of NPAs.

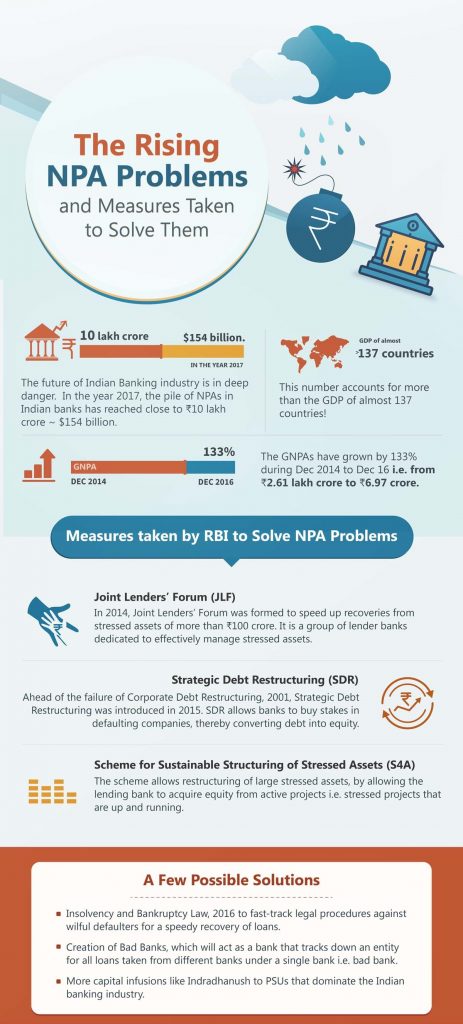

Improving Legal and Regulatory Frameworks:

Governments and regulatory bodies play a crucial role in addressing the issue of NPAs. Enhancing legal frameworks and implementing stringent regulations can act as a deterrent against defaulting behavior while providing efficient mechanisms for resolution.

Debt Restructuring and Rehabilitation:

Financial institutions can consider debt restructuring to provide relief to borrowers facing temporary financial difficulties. This involves modifying the terms of the loan to make repayment more manageable. Additionally, rehabilitation measures, such as providing financial counseling and support, can help businesses recover and repay their debts.

Asset Quality Review (AQR):

Periodic AQRs can assist financial institutions in identifying and addressing potential NPAs. A thorough assessment of the asset quality can reveal hidden risks and vulnerabilities, enabling institutions to take corrective actions promptly.

Conclusion

Non-Performing Assets pose a significant challenge to the financial stability of institutions and the broader economy. Addressing the root causes of NPAs through improved risk management, monitoring mechanisms, legal frameworks, and rehabilitation measures is crucial for sustained economic growth. By implementing effective strategies and fostering a culture of responsible lending, financial institutions and policymakers can work together to minimize the impact of NPAs and create a healthier financial ecosystem.